The supervisor requires insurers to disclose relevant and comprehensive information on a timely basis in order to give policyholders and market participants a clear view of their business activities, risks, performance and financial position.

Public disclosure of material information is expected to enhance market discipline by providing meaningful and useful information to policyholders to make decisions on insuring risks with the insurer, and to market participants (which includes existing and potential investors, lenders and other creditors) to make decisions about providing resources to the insurer.

So far as practicable, information should be presented in accordance with any applicable jurisdictional, international standards or generally accepted practices so as to aid comparisons between insurers.

In setting public disclosure requirements, the supervisor should take into account the information provided in general purpose financial statements and complement it as appropriate. The supervisor should note that insurers which provide public general purpose financial reports may largely comply with jurisdictional disclosure standards that are reflective of this ICP. Where a supervisor publishes on a regular and timely basis information received from insurers, the supervisor may decide that those insurers do not need to publicly disclose that same information.

To the extent that there are differences between the methodologies used in regulatory reporting, general purpose financial reporting and any other items for public disclosure, such differences should be explained and reconciled where possible.

The supervisor’s application of disclosure requirements will depend on the nature, scale and complexity of insurers. For example, it may be overly burdensome for a small, private insurer to meet the same requirements developed for large, publicly traded insurers. While disclosure requirements may vary, the outcome should promote market discipline and provide policyholders and market participants with adequate information for their needs.

Additionally, the supervisor may decide not to apply disclosure requirements if there is no potential threat to the financial system, no public interest need for disclosure, and no legitimately interested party is prevented from receiving information. It is expected that such situations would be exceptional, but could be more relevant for certain types of insurers (for example, captive insurers).

Public disclosure may include a description of how information is prepared, including methods applied and assumptions used. Disclosure of methods and assumptions may assist policyholders and market participants in making comparisons between insurers. Accounting and actuarial policies, practices and procedures differ not only between jurisdictions but also between insurers within the same jurisdiction. Meaningful comparisons can be made only where there is adequate disclosure of how information is prepared.

Similarly, meaningful comparisons from one reporting period to another can be made only if the reader is informed how the methods and assumptions of preparation have changed and, if practicable, the impact of that change. Changes over time may not be seen as arbitrary if the reasons for changes in methods and assumptions are explained. If an insurer uses methods and assumptions in the preparation of information which are consistent from period to period, and discloses these, it will assist in the understanding of trends over time.

Where changes in methods and assumptions are made, the nature of such changes, the reason for them and their effects, where material, should be disclosed. It may be helpful if information is presented in a manner that facilitates the identification of patterns over time, including providing comparative or corresponding figures from previous periods (eg by presenting loss triangulations).

In establishing disclosure requirements for its jurisdiction, the supervisor should consider the need for disclosures that deliver key information rather than unnecessary volumes of data. Excessive disclosure requirements will not lead to effective disclosures for policyholders and market participants and will be burdensome for insurers.

In establishing disclosure requirements, the supervisor should take into account proprietary and confidential information. Proprietary information comprises information on characteristics and details of, for example, insurance products, markets, distribution and internal models and systems that could negatively influence the competitive position of an insurer if made available to competitors. Information about policyholders and insured parties is usually confidential under privacy legislation or contractual arrangements.

Proprietary and confidential information affects the scope of the required disclosure of information by insurers about their customer base and details on internal arrangements (for example, methodologies used or parameter estimates data). The supervisor should strike an appropriate balance between the need for meaningful disclosure and the protection of proprietary and confidential information.

A consolidated group as determined under applicable accounting standards may differ from a group for the purposes of insurance supervision (see ICP 23 Group-wide Supervision). In circumstances where this is the case, the supervisor may require disclosures based on the scope of the group for supervisory purposes. Where an insurer’s scope of the group is different under applicable accounting standards and solvency standards, it may be appropriate if reasons are provided and an explanation given about the basis on which disclosures have been provided.

Disclosures by insurance legal entities may cross-refer to existing public disclosures to avoid duplication.

Subject to their nature, scale and complexity, insurers make audited financial statements available at least annually.

Where audited financial statements are not required by the supervisor given the nature, scale and complexity of an insurer (for example, for a small local branch office of a foreign insurer), the supervisor may require that similar information is made publicly available by other means.

- company profile;

- corporate governance framework;

- technical provisions;

- insurance risk exposure;

- financial instruments and other investments;

- investment risk exposure;

- asset-liability management;

- capital adequacy;

- liquidity risk; and

- financial performance.

- easily accessible and up-to-date;

- comprehensive, reliable and meaningful;

- comparable between different insurers operating in the same market;

- consistent over time so as to enable relevant trends to be discerned; and

- aggregated or disaggregated so that useful information is not obscured.

Information should be disseminated in ways best designed to bring it to the attention of policyholders and market participants, but taking into account the relative effectiveness and costs of different methods of dissemination (for example, printed versus digital methods).

Information should be provided with sufficient frequency and timeliness to give a meaningful picture of the insurer to policyholders and market participants. The need for timeliness will need to be balanced against that for reliability.

Disclosure requirements may also have to balance the interests of reliability against those of relevance or usefulness. For example, in some long-tail classes of insurance, realistic projections as to the ultimate cost of incurred claims are highly relevant. However, due to uncertainties, such projections are subject to a high degree of inherent errors of estimation. Qualitative or quantitative information can be used to convey to users an understanding of the relevance and reliability of the information disclosed.

- well-explained so that it is meaningful;

- complete so that it covers all material circumstances of an insurer and, where relevant, those of the group of which it is a member; and

- both appropriately aggregated so that a proper overall picture of the insurer is presented and sufficiently disaggregated so that the effect of distinct material items may be separately identified.

Information should, so far as practicable, reflect the economic substance of events and transactions as well as their legal form. The information should be neutral (ie, free from material error or bias) and complete in all material respects..

- the nature of its business;

- its corporate structure;

- key business segments;

- the external environment in which it operates; and

- its objectives and the strategies for achieving those objectives.

The overall aim for the company profile disclosure is for insurers to provide a contextual framework for the other information required to be made public.

Disclosures on the nature of the insurer’s business and its external environment should assist policyholders and market participants in assessing the strategies adopted by the insurer.

Disclosures may include information about the insurer’s corporate structure, which should include any material changes that have taken place during the year. For insurance groups, where provided, such disclosures should focus on material aspects, both in terms of the legal entities within the corporate structure and the business functions undertaken within the group. In the event of differences in the composition of a group for supervisory purposes and for public reporting purposes, it would be useful if a description of the entities constituting those differences was also provided.

Disclosures may include information on the key business segments, main trends, factors and events that have contributed positively or negatively to the development, performance and position of the company.

Disclosures may include information on the insurer’s competitive position and its business models (such as its approach to dealing and settling claims or to acquiring new business) as well as significant features of regulatory and legal issues affecting its business.

Disclosures may include information about company objectives, strategies and timeframes for achieving those objectives, including the approach to risk appetite, methods used to manage risks, and key resources available. To enable policyholders and market participants to assess these objectives, and the insurer's ability to achieve them, it may be appropriate if the insurer also explains significant changes in strategy compared to prior years.

Key resources available may include both financial and non-financial resources. For non-financial resources the insurer may, for example, provide information about its human and intellectual capital.

The supervisor requires that disclosures about the insurer’s corporate governance framework provide information on the key features of the framework, including its internal controls and risk management, and how they are implemented.

Disclosures should include the manner in which key business activities and control functions are organised, and the mechanism used by the Board to oversee these activities and functions, including for changes to key personnel and management committees. Such disclosures should demonstrate how the key activities and control functions fit into an insurer’s overall risk management framework.

Where a material activity or function of an insurer is outsourced, in part or in whole, disclosures may include the insurer’s outsourcing policy and how it maintains oversight of, and accountability for, the outsourced activity or function.

- the future cash flow assumptions;

- the rationale for the choice of discount rates;

- the risk adjustment methodology where used; and

- other information as appropriate to provide a description of the method used.

Disclosures related to technical provisions should provide information on how those technical provisions are determined. As such, disclosures may include information about the level of aggregation used and the amount, timing and uncertainty of future cash flows in respect of insurance obligations.

Disclosures should include a presentation of technical provisions and reinsurance assets on a gross basis. However, it may be useful to have information about technical provisions presented on both a net and gross basis.

Information may be disclosed about the method used to derive the assumptions for calculating technical provisions, including the discount rate used. Disclosures may also include information about significant changes in assumptions and the rationale for the changes.

When applicable, information about the current estimate and margin over the current estimate may include the methods used to calculate them, whether or not these components of technical provisions are determined separately. If the methodology has changed since the last reporting period, it would be useful to include the reasons for the change and any material quantitative impact.

It may be useful if the insurer provides an outline of any model(s) used and describe how any range of scenarios regarding future experience has been derived.

Disclosures may include a description of any method used to treat acquisition costs and whether future profits on existing business have been recognised.

Where surrender values are material, disclosures may include the insurer’s surrender values payable.

Disclosure of a reconciliation of technical provisions from the end of the previous year to the end of the current year may be particularly useful.

- one part that covers claims from insurance events which have already taken place at the date of reporting (claims provisions not enough reported (IBNER) provisions) and for which there is an actual or potential liability; and

- another part that covers losses from insurance events which will take place in the future (for example, the sum of provision for unearned premiums and provision for unexpired risks (also termed premium deficiency reserve)).

Providing this disclosure in two parts is particularly important for lines of insurance business where claims may take many years to settle.

It may be useful if the disclosures include key information on the assumed rates, the method of deriving future mortality and disability rates, and whether customised tables are applied. Disclosures may include a life insurer’s significant assumptions about future changes of mortality and disability rates.

It may enhance policyholder and market participant understanding if disclosures include information on the conditions for the amount and timing of the allocation of participation features and how such features are valued in technical provisions. Required disclosures could include whether participation features are based on: the performance of a group of contracts; the realised/unrealised investment returns from a pool of assets; the profit or loss of the company; or any other element. Disclosures could also be required on the extent to which such features are contractual and/or discretionary.

- guaranteed policyholder benefits paid; and

- additional policyholder benefits paid which arise from profit sharing clauses.

Disclosures may include the assumptions and methodologies employed to value significant guarantees and options, including the assumptions concerning policyholder behaviour.

In order to enable policyholders and market participants to evaluate trends, disclosures for non-life insurers may include historical data about earned premiums compared to technical provisions by class of business. To assess the appropriateness of assumptions and methodology used for determining technical provisions, historical data on the run off result and claims development could be disclosed.

To facilitate the evaluation of a non-life insurer’s ability to assess the size of the commitments to indemnify losses covered by the insurance contracts issued, disclosures for non-life insurers may include the run off results over many years, to enable policyholders and market participants to evaluate long-term patterns (for example, how well the insurer estimates the technical provisions). The length of the time period should reflect how long-tailed the distribution of losses is for the insurance classes in question.

Non-life insurers may disclose information on the run off results for incurred losses and for the provisions for future losses.

Disclosures for non-life insurers may include the run off results as a ratio of the initial provisions for the losses in question. When discounting is used, disclosures should include the effect of discounting.

Except for short-tail business, the supervisor may require non-life insurers to disclose information on the development of claims in a claims development triangle. A claims development triangle shows the insurer's estimate of the cost of claims (claims provisions and claims paid), as of the end of each year, and how this estimate develops over time. This information should be reported consistently on an accident year or underwriting year basis and reconciled to amounts reported in the balance sheet.

- the nature, scale and complexity of risks arising from its insurance contracts;

- the insurer’s risk management objectives and policies;

- models and techniques for managing insurance risks (including underwriting processes);

- its use of reinsurance or other forms of risk transfer; and

- its insurance risk concentrations.

Disclosures may include a quantitative analysis of the insurer’s sensitivity to changes in key factors both on a gross basis and taking into account the effect of reinsurance, derivatives and other forms of risk mitigation on that sensitivity. For example, disclosures may include a sensitivity analysis by life insurers to the changes in mortality and disability assumptions or sensitivities to increased claim inflation by non-life insurers.

Where an insurance group includes legal entities in other sectors, disclosures may include the risk exposure of the insurance legal entities from those other entities and procedures in place to mitigate those risks.

Disclosures may include a description of the insurer’s risk appetite and its policies for identifying, measuring, monitoring and controlling insurance risks, including information on the models and techniques used.

Disclosures may include information on the insurer’s use of derivatives to hedge risks arising from insurance contracts. This information may include a summary of internal policies on the use of derivatives.

Disclosure of how an insurer uses reinsurance and other forms of risk transfer may enable policyholders and market participants to understand how the insurer controls its exposure to insurance risks.

Description of the insurer's risk concentrations may include, at least, information on the geographical concentration of insurance risk, the economic sector concentration of insurance risk, the extent to which the risk is reduced by reinsurance and other risk mitigating elements and, if material, the risk concentration inherent in the reinsurance cover.

- the credit quality of the reinsurers (for example, by grouping reinsurance assets by credit rating);

- credit risk concentration of reinsurance assets;

- the nature and amount of collateral held against reinsurance assets;

- the development of reinsurance assets over time; and

- the ageing of receivables from reinsurers on settled claims.

It may be useful if disclosures include the impact and planned action when the expected level or scope of cover from a reinsurance/risk transfer contract is not obtained.

These ratios should be calculated from the profit and loss account of the reporting year and be gross of reinsurance in order to neutralize the effect of mitigation tools on the technical performance of the direct business. Gains on reinsurance cannot be expected to continue indefinitely without price adjustments from reinsurers. Disclosure on reinsurance is described in Guidance 20.7.2. If the net ratios are materially different from the gross ratios, then both ratios should be disclosed. The ratios should be measured either on an accident year or an underwriting year basis.

Disclosures may include the geographical concentration of premiums. The geographical concentration may be based on where the insured risk is located, rather than where the business is written.

If material, disclosures may include the number of reinsurers that it engages, as well as the highest concentration ratios. For example, it would be appropriate to expect an insurer to disclose its highest premium concentration ratios, which shows the premiums ceded to an insurer’s largest reinsurers in aggregate, as a ratio of the total reinsurance premium ceded.

- instruments and investments by class;

- investment management objectives, policies and processes; and

- values, assumptions and methods used for general purpose financial reporting and solvency purposes, as well as an explanation of any differences, where applicable.

For the purposes of disclosure, an insurer may group assets and liabilities with similar characteristics and/or risks into classes and then disclose information segregated by those classes.

Where investment management objectives, policies and processes differ between segments of an insurer’s investment portfolio, disclosures should be sufficient to provide an understanding of those differences.

When providing disclosures around the uncertainty of reported values of financial instruments and other investments, it may be useful if the effect of derivatives on that uncertainty is also disclosed.

The supervisor requires disclosures about the insurer’s material investment risk exposures, and their management.

- currency risk;

- market risk;

- credit risk; and

- concentration risk.

The risks listed above may affect both assets and liabilities. For example, market risk arising from interest rate movement may be reflected in changes in the valuation of an insurer’s fixed income investments as well as changes in the valuation of insurance liabilities if they are discounted using market interest rates. Changes in interest rates may also change the amounts that an insurer has to pay for its variable rate borrowings. Therefore, required disclosure may include the risk exposure arising from both an insurer’s assets and its liabilities.

Disclosures may include the investment return achieved together with the risk exposure and investment objective. Disclosure of risk exposures can provide policyholders and market participants with valuable insight into both the level of variability in performance that one can expect when economic or market conditions change, and the ability of an insurer to achieve its desired investment outcome.

For investment risk exposures, disclosures may include the intra-period high, median and low exposures where there have been significant changes in exposure since the last reporting date. Disclosures may also include the amount bought and sold during a reporting period as a proxy for turnover. Such disclosure of risk exposures may also be required for each asset class.

In jurisdictions that require investment disclosures to be grouped by risk exposure, the disclosures should provide information about the risk management techniques used to measure the economic effect of risk exposure. Such disclosure may include an analysis by type of asset class.

Disclosures may include information on its use of derivatives to hedge investment risks, including a summary of internal policies on the use of derivatives.

Disclosures may include information on whether or not the insurer it carries out stress tests or sensitivity analysis on its investment risk exposures (for example, the change in capital resources as a percentage of total assets corresponding to a 100 basis point change in interest rates), and, if so, disclose the model, process and types of assumptions used and the manner in which the results are used as part of its investment risk management practices.

For debt securities, disclosures on the sensitivity of values to market variables including credit spreads may include breakdowns by credit rating of issue, type of issuer (eg government, corporate) and by period to maturity.

In addition to breakdowns on ratings and types of credit issuers, the insurer should disclose the aggregate credit risk arising from off-balance sheet exposures.

- ALM in total and, where appropriate, at a segmented level;

- the methodology used and the key assumptions employed in measuring assets and liabilities for ALM purposes; and

- any capital and/or provisions held as a consequence of a mismatch between assets and liabilities.

To provide information on its ALM approach, disclosures may include qualitative information explaining how the insurer manages assets and liabilities in a co-ordinated manner. The explanation could take into account the ability to realise its investments quickly, if necessary, without substantial loss, and sensitivities to fluctuations in key market variables (including interest rate, exchange rate, and equity price indices) and credit risks.

Where an insurer’s ALM is segmented (eg by different lines of business), disclosures may include information on ALM at a segmented level.

Where derivatives are used, it may be useful if the disclosures include a description of both the nature and effect of their use.

- changes in the value of assets; and

- changes in the discount rate or rates used to calculate the value of the liabilities.

- its objectives, policies and processes for managing capital and assessing capital adequacy;

- the solvency requirements of the jurisdiction(s) in which the insurer operates; and

- the capital available to cover regulatory capital requirements. If the insurer uses an internal model to determine capital resources and requirements, information about the model is disclosed.

It may be useful if the insurer discloses information to allow market participants to assess the quantity and quality of its capital in relation to regulatory capital requirements.

Information about objectives, policies and processes for managing capital adequacy assist in promoting the understanding of risks and measures which influence the capital calculation and the risk appetite that is applied.

- instruments regarded as available capital;

- key risks and measures which influence the capital calculation; and

- the insurer’s risk appetite.

It may be useful if the disclosures include a description of any variation in the group as defined for capital adequacy purposes from the composition of the group used for general purpose financial reporting purposes.

The supervisor requires that disclosures about the insurer’s liquidity risk include sufficient quantitative and qualitative information to allow a meaningful assessment by market participants of the insurer’s material liquidity risk exposures.

- quantitative information on the insurer’s sources and uses of liquidity, considering liquidity characteristics of both assets and liabilities; and

- qualitative information on the insurer’s liquidity risk exposures, management strategies, policies and processes.

Disclosures should discuss known trends, significant commitments and significant demands. Disclosures should also discuss reasonably foreseeable events that could result in the insurer's liquidity position improving or deteriorating in a material way.

- earnings analysis;

- claims statistics including claims development;

- pricing adequacy; and

- investment performance.

Disclosures should help policyholders and market participants better understand how profit emerges over time from new and in-force insurance contracts.

Disclosure may include a statement of changes in equity showing gains and losses recognised directly in equity as well as capital transactions with, and distributions to, shareholders, and profit sharing with policyholders.

Disclosures may include information on its operating segments and how they were determined.

- type of business: life insurance, non-life insurance, investment management; and

- mix of organisational and geographic approach: eg insurance jurisdiction X, insurance jurisdiction Y, insurance (other), asset management jurisdiction Z.

Disclosures may include the impact of amortisation and impairment of intangible assets on financial performance.

The insurer may provide statements of profit and loss that include the results, both gross and net of reinsurance, of their underwriting by broad lines of business.

If the insurer is a ceding insurer, disclosures may include gains and losses recognised in profit or loss on buying reinsurance.

- loss ratio;

- expense ratio;

- combined ratio; and

- operating ratio.

These ratios should be calculated from the profit and loss account of the reporting year and be gross of reinsurance in order to neutralise the effect of mitigation tools on the technical performance of the direct business. Gains on reinsurance cannot be expected to continue indefinitely without price adjustments from reinsurers. If the net ratios are materially different from the gross ratios, then both ratios should be disclosed. The ratios should be measured either on an accident year or an underwriting year basis.

When discounting is used, disclosures may include information on the discount rates used and method of discounting to be disclosed. The discount rates should be disclosed at an appropriate level of aggregation by duration, for example, for each of the next five years and the average rate for claims expected to be paid after five years.

Such disclosure should be accompanied by supporting narrative, covering an appropriate period, to enable policyholders and market participants to evaluate long-term trends better. Information relating to previous years should not be recalculated to take into account present information. The length of the period may reflect the historical volatility of the particular class of insurance business.

It may be appropriate in the case of high volume, homogeneous classes, for the supervisor to require insurers to disclose statistical information on claims. For instance, the insurer could describe the trend in the number of claims and the average size of claims. To be relevant, this information should be linked to the level of business (eg number of policies or earned premiums).

- the mean cost of claims incurred (ie, the ratio of the total cost of claims incurred to the number of claims) in the accounting period by class of business; and

- claims frequency (for example, the ratio of the number of claims incurred in the reporting period to the average number of insurance contracts in existence during the period).

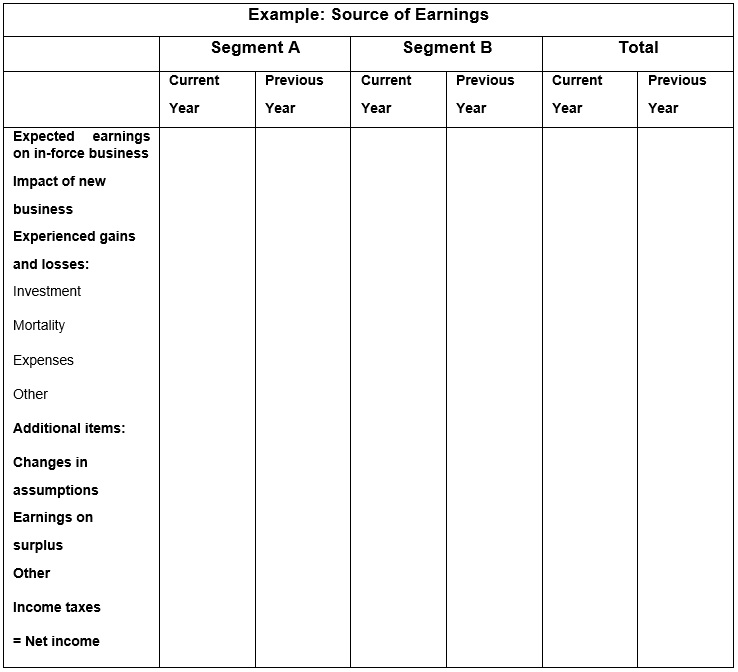

Where an applicable jurisdictional standard does not require a similar analysis to be disclosed, it may be useful for disclosures to include expected earnings on in-force business. This represents the earnings on the in-force business that were expected to be realised during the reporting period. Examples of this include expected release of risk margins, net management fees, and earnings on deposits.

Life insurers may disclose the impact of new business. This represents the point-of-sale impact on net income of writing new business during the reporting period. This is the difference between the premium received and the sum of the expenses incurred as a result of the sale and the new technical provisions established at the point of sale. This is also affected by any methodology used to defer and amortise acquisition expenses.

It may be useful for life insurers to disclose experience gains and losses. This represents gains and losses that are due to differences between the actual experience during the reporting period and the technical provisions at the start of the year, based on the assumptions at that date.

Life insurers may disclose the impact on earnings of management actions and changes in assumptions.

Investment performance is one of the key determinants of an insurer’s profitability. For many life insurance policies, returns that policyholders receive are either directly or indirectly influenced by the performance of an insurer’s investments. Disclosure of investment performance is, therefore, essential to policyholders and market participants.

Disclosure of investment performance may be made on appropriate subsets of an insurer’s assets (for example, assets belonging to the insurer’s life insurance business, assets belonging to statutory or notionally segregated portfolios, assets backing a group of investment-linked contracts, assets grouped as the same asset class).

For investment performance related to equity securities, debt securities, properties and loans, the disclosures may include a breakdown of income (eg dividend receipts, interest income, rental income), realised gains/losses, unrealised gains/losses, impairments including changes in loan loss provisions and investment expenses.

Insurers that publicly disclose non-GAAP financial measures are required to adhere to the specified practices regarding those measures, where applicable.

In many jurisdictions, publicly-listed insurers are expected to adhere to specific practices, for disclosure of non-GAAP financial measures, which have been promulgated by the domestic securities supervisor. The supervisor could consider standards promulgated by the domestic securities supervisor appropriate.

If no such requirements exist from the domestic securities supervisor for non-GAAP financial measures, the supervisor may promulgate requirements for insurers based on considerations of best practices and existing international guidance from key standard setting bodies dealing with financial disclosures.